Can you trust your reports and visuals?

Do you rely on reports to run the business — or to explain losses after they happen?

Dashboards tell you what already hit your P&L.

They do not tell you what is forming underneath it.

Power BI, Tableau or any reporting tool explain what happened.

Data Insight reveals what is quietly building and what can happen — and what it will cost you next if ignored.

Every major financial shock starts as a small, invisible pattern buried inside the data:

margin leakage, claim severity shifts, inventory imbalance, customer risk, case weakness.

If you are running the business from reports, you are reacting.

If you are running it from Data Insight, you are intervening before the damage appears.

Ten minutes with this demo will permanently change how you see your numbers — and how much risk you are actually carrying.

Static reporting is backward-looking by design

Power BI, Tableau, Looker, etc. are presentation layers.

They show you:

Revenue

Margin

Volume

KPIs

Trends

Variances

All of that is useful — but it’s already in your P&L.

Data Insight works on signals, not totals

Executives don’t lose money because they lack dashboards.

They lose money because weak signals are buried inside averages.

Data Insight does not ask:

“How did we do last month?”

It asks:

“What pattern is forming that will hit our numbers next?”

The brutal truth executives know

If Power BI or Tableau really solved risk:

Banks wouldn’t blow up

Insurers wouldn’t miss reserve gaps

Retailers wouldn’t get stuck with dead inventory

Manufacturers wouldn’t have sudden margin collapses

Law firms wouldn’t lose cases they thought were “fine”

They all had dashboards.

What they didn’t have was early-warning insight.

That is exactly the gap your Data Insight + Blind-Spot model fills.

Learn about blind spots.

Observe in the demo shown below how deep the AI Insight goes to identify issues, also known as blind spots, and suggest recommendations to fix them with executive action items. Humans miss out on the blind spot, but AI does not. We specialize in identifying blind spots Once it hits P&L, it’s too late to reverse. Witness in demo.

Feel free to play around with these data sets.

Maybe your dataset, too, could tell you a story. Prevent losses before it’s too late. Insight is all about reading between the lines and predicting early.

White Level Business Model

We believe in working jointly as a white-level partner.

1. We bring in the technology, resources, and experience to build this capability.

2. In exchange, you provide your clients whom we serve.

FUTURE PROJECTION IS ONE OF THE DESPERATE NEEDS FOR EXECUTIVES, TO PREPARE THEMSELVES FROM ODDS.

DIRECT CLIENTS

We also work with direct clients. For more detail a conversation would be appropriate.

Build Proof Of Concept (PoC)

If you are not absolutely certain what your data is not telling you—what hides between the lines—you are already exposed.

Most business damage doesn’t arrive with alarms.

It settles quietly into your P&L, one decision at a time—missed signals, delayed reactions, false confidence from “good” reports. By the time it becomes visible, the loss is already booked and cannot be reversed.

Waiting costs far more than acting.

Introduce yourself and receive a complimentary 3-question insight analysis from one dataset.

No assumptions. No theory. Just facts your data has already recorded.

The small amount you invest in clarity today can prevent thousands in silent leakage tomorrow.

Because losses caused by ignored data don’t announce themselves—

they only show up later, when it’s too late to undo them.

Small or mid-sized CPA firms will find it suitable.

1. No need to hire skills and resources. AI/ML skills are expensive.

2. Ready-to-market.

3. Offer something new to the client. Executives want to know what’s coming, not what already happened. Ideal for an advisory or consulting role.

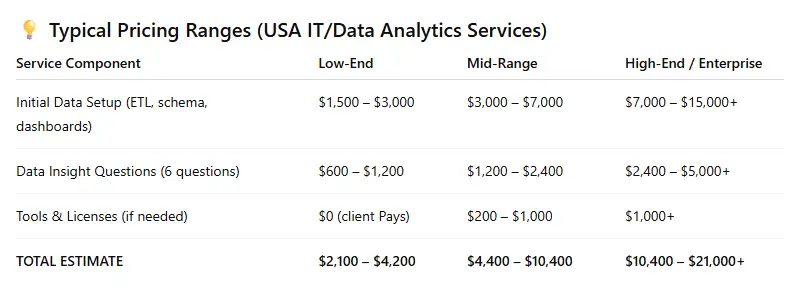

Pricing

Designed to lower AI operating cost while improving decision quality.

The retainer model gives you access to the capabilities required to run and improve predictive and LLM-based models—without carrying the fixed cost of full-time Subject Matter Experts (SME’s), AI engineers, Analysts, or Architects.

You get clean data, governed models, and usable insights—focused on outcomes, not headcount.

The demo shown below is a proof of what will be delivered. Depends on dataset and questions.

There are 2 cost components. (i) Set Up (ii) Maintenance

Setup would depend on the size of table(s) and number of tables which the LLM has to be trained with.

Retainer would involve monthly maintenance and also includes small alterations like adding executive questions on the same data set.

Only pay for extra work when needed

Data preparation and enrichment available at $100/hour, subject to availability

USA Average Rate for Data Insights

Our set up rate would depend on (i) database size (ii) number of tables (iii) number of questions

We provide a new domain to every client to manage the app for you.

Dashboards explain what already happened. Data insight reveals what is forming next.

Reports summarize outcomes after financial impact is locked in; insight exposes early signals, hidden risk, and decision leverage while there is still time to act.

That difference is the margin between managing results and leading outcomes.

Interactive Demo for Financial, Supply Chain, Manufacturing, Insurance, Retail, Pharma, and Law Industries.

Financial Industry

Supply Chain

Manufacturing Industry

Insurance Industry

Retail Industry

Pharma Industry

Law Industry

Power BI, Tableau, and similar reporting tools are excellent at visualization and reporting, but they primarily show predefined metrics and historical trends. They answer questions you already decided to ask.

Data insight comes from how data is explored, questioned, and interpreted—not from the tool itself.

Without analytical framing, pattern discovery, and decision-focused interpretation, BI tools remain reporting engines, not insight engines.